Open for Inspiration

I have posted before on the value of keeping one’s mind open to inspiration. A random event recently reminded me how inspiration comes at every scale. Ever got hot and needed to wrap your top around your waist because you don’t want to carry it in your hands? Ever had it slip off your waist repeatedly no matter how tightly you tie a knot in the arms? Have you had it fall off and get chewed in your bike wheel? When we were cycling recently with our friend Aaron I noticed that he was zipping up the bottom of his top around his waist and then tying the arms together. The top couldn’t fall off because it was zipped on. Why did I never think of that in several decades of tying tops around my waist? At least, thanks to Aaron, my top won’t go in my bike wheel ever again. The proper way of wearing a top round your waist is demonstrated in the above photo and yes I know it isn’t stylish.

It turns out the US Federal Reserve also has problems keeping its mind open – I’m in good (or at least ‘elite’) company. The Fed have come out and said that the reason they didn’t act earlier on inflation was because they didn’t believe it would get out of hand. How can that be? A bunch of experts on money matters couldn’t predict that inflation would result from printing heaps of money? Basic economy theory says that as supply increases demand and value decrease.

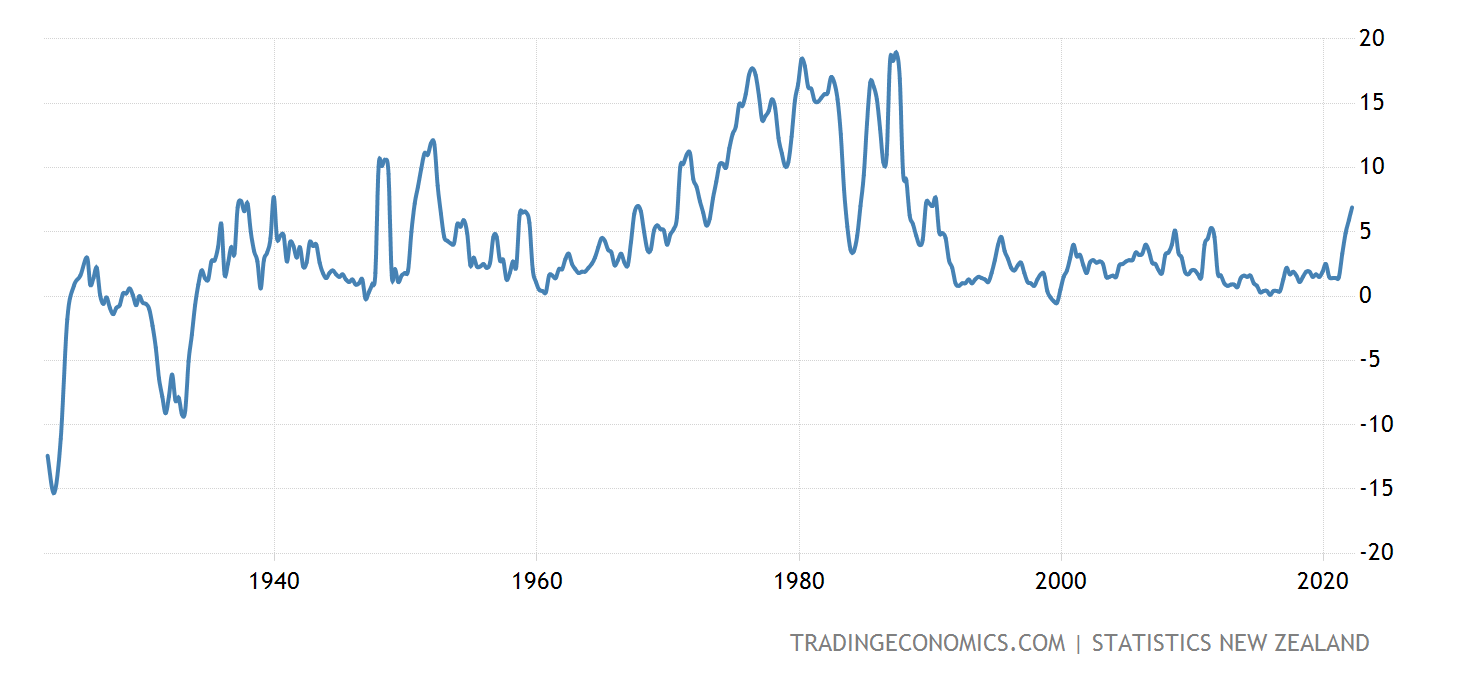

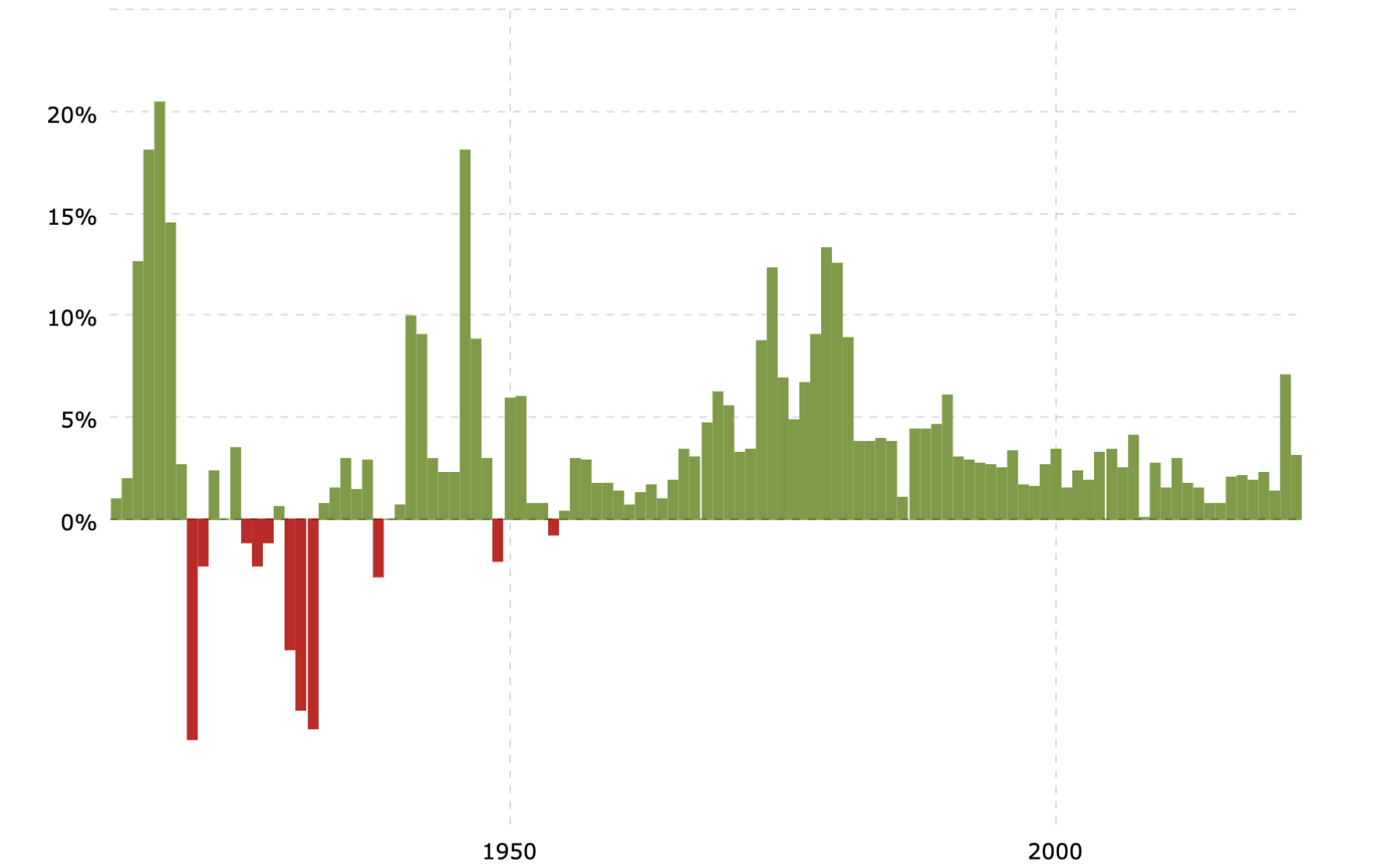

However, after three decades of low inflation, governments and their advisors all over the world thought low inflation was here to stay. Below are graphs of inflation in NZ and the USA since the early 1900s. In the years of the Great Depression inflation went into seriously negative territory that it hasn’t returned to, although deflation was threatened a year ago. You can see why everyone believed that inflation was under control. A whole generation’s timeframe in which inflation didn’t go above 5%.

It doesn’t matter how ‘smart’ we are as humans, we are all subject to the same ‘heuristic traps’ or ‘cognitive biases’. We use heuristics as simple rules that allow us to make complex decisions. For example, the clearer an object appears, the closer we assume it must be. This allows us to make snap decisions about e.g. crossing the road, rather than having to carefully consider how fast all traffic might be moving.

The concept of heuristics and consequent biases was introduced in the 1950s by the Nobel-prize winning economist and cognitive psychologist Herbert Simon – he considered that, while people strive to make rational choices, human judgment is subject to cognitive limitations. It was further developed in the 1970s by psychologists Amos Tversky and Daniel Kahneman, who identified ways we simplify decision making (heuristics) and the resultant ‘ cognitive biases ‘.

Three (of the many) cognitive biases that will have influenced lack of prediction of the current bout of inflation being experienced worldwide are:

- The availability bias : how likely we think something is to happen is based on our experience of it happening in the past. If we know someone who died in a plane crash we are more likely to be scared of flying than if we have never had any exposure to plane crash events. If inflation has been at 1-5% our entire career, we are not likely to have a strong belief it will go outside that band.

- The confirmation bias : we listen more to information supporting our existing beliefs. If we already believe inflation won’t rise then we will be listening harder to the reasons it won’t rise, than the reasons that it might.

- Optimism bias : we tend to overestimate the likelihood that good things will happen, and underestimate the likelihood negative things will happen. This is a useful bias to allow you to live a happy life, but less useful if the point of your role is accurately predicting bad things (such as inflation) in order to prevent them. The Economist suggests that there is still an underestimation of how high inflation will go, and thus a reluctance on the part of central banks to raise official cash rates quickly enough or high enough.

I have some advice for the Fed. If humans are going to be biased, we should make the most of those biases. So I suggest that they reinforce the need of their economists and financiers to stay open-minded by using humour bias . Supposedly, humour:

- Helps memory because remembering a joke costs effort which makes connections stronger in the brain.

- Makes people pay attention, because they like funny information.

Clearly, what we need are that our politicians and financial institutions are trained to remember our current financial situation is a merely temporary phenomenon, and they should always keep their minds open about it changing, by joking about it.

Do you think this would help?